Homeowners’ insurance typically includes liability protection to help cover costs if someone is injured on your property or if you’re responsible for damaging someone else’s property. However, certain activities or features around your home can significantly raise the level of risk and your chances of facing a lawsuit. This is where elevated or atypical liability exposure comes into play. These are risks tied to specific items or behaviors that go beyond standard personal liability. But what exactly qualifies as high-risk exposure in a homeowners insurance context — and why should Florida homeowners pay special attention?

What Is Elevated or High-Risk Liability Exposure?

Not all liability claims stem from ordinary circumstances. For instance, if a visitor slips on your walkway, it’s a typical liability scenario generally covered by the standard limits in your policy’s Coverage E. But some activities inherently carry higher danger and a greater likelihood of legal claims.

This type of exposure often includes risks associated with potentially dangerous features or recreational equipment, such as:

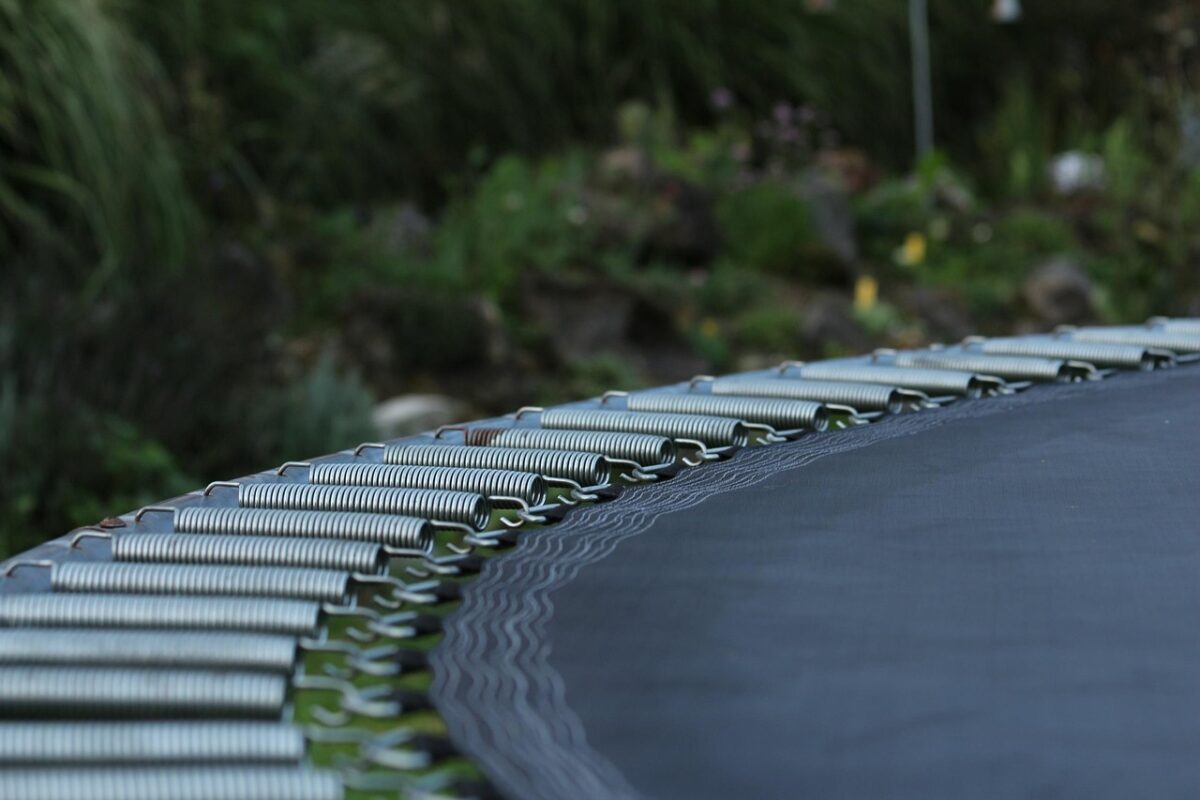

Trampolines: Frequently linked to concussions, fractures, and spinal trauma.

Ramps for bikes or skateboards: Increase the chances of falls and serious injury.

Pool slides and diving boards: Misuse or accidents can result in major medical emergencies.

Unsecured pools or hot tubs: Without fences or covers, these become legal liabilities.

Motorized devices: E-bikes, electric scooters, and hoverboards can cause off-property accidents.

Whether you own, rent, or simply allow the use of these high-risk items, you may be held responsible for any resulting injuries—even if the incident happens away from your home. That’s why it’s crucial to understand how these liabilities fit into your coverage.

Why Florida Homeowners Should Pay Close Attention

Lawsuits stemming from elevated-risk items can come with hefty financial consequences. Florida’s legal climate can be especially challenging, as homeowners might be held liable even in cases where they had limited or no involvement.

For example, if a child next door uses your trampoline without asking and gets injured, you could still be found liable. If a pedestrian is struck by your electric scooter, you could face a personal injury lawsuit. An even if a trespasser drowns in your unfenced pool, under Florida’s “attractive nuisance” rule, you might be held accountable.

Even with good safety practices, accidents are unpredictable. That’s why it’s vital to review your homeowner’s policy for any exclusions tied to high-risk items.

Do Insurance Policies Always Include High-Risk Events?

Many homeowners wrongly assume that their insurance covers every type of liability. In reality, coverage for high-risk exposures can vary significantly from one insurer to another. Some companies outright exclude coverage for trampolines, diving boards, or skate ramps; while others may offer coverage but only if specific safety standards are met.

Additionally, motorized recreational devices are frequently excluded unless added via a special endorsement. To avoid surprises, it’s important to read your policy carefully and consult your insurance provider about any exclusions.

How Umbrella Policies Fit into the Picture

An umbrella policy steps in when your homeowner’s insurance liability limits are maxed out. For example, if your standard policy covers up to $300,000 and you’re sued for $600,000, an umbrella policy could help cover the additional $300,000—if the underlying risk is included.

Umbrella coverage typically applies to:

- Bodily injury claims

- Property damage

- Legal defense costs

Still, umbrella policies may exclude the same high-risk activities unless specifically endorsed.

Minimizing Your Liability Risk

To reduce your chances of facing liability-related lawsuits, consider taking the following steps:

- Secure your pool or hot tub with fences, locks, and covers.

- Supervise all high-risk activities and ensure proper safety equipment is used.

- Understand state laws like Florida’s attractive nuisance doctrine, which can hold homeowners accountable for injuries to trespassers.

- Review your policy regularly to confirm you’re covered for elevated liability risks.

Is Your Liability Coverage Sufficient?

Now that you’re more familiar with what constitutes unusual or excessive liability exposure, take time to evaluate your current coverage. Are you protected from the financial impact of a high-risk accident?

A conversation with Anderson & Associates Insurance Group can clarify any gaps and help you secure additional coverage if needed.