The Importance of Flood Insurance

Flooding can cause extensive damage to homes, businesses, and infrastructure. Unfortunately, standard homeowners’ insurance policies often do not cover flood damage. This is where flood insurance becomes essential. The Federal Emergency Management Agency (FEMA) administers the National Flood Insurance Program (NFIP), which provides flood coverage to property owners, renters, and businesses in participating communities. Given Florida’s high risk for flooding, having flood insurance can be a critical safeguard.

Types of Flood Insurance Coverage

Flood insurance through the NFIP is divided into two main types of coverage:

- Building Coverage: This protects the structure of your home or business. It covers damage to the building itself, including its foundation, electrical and plumbing systems, HVAC systems, and major appliances. For homeowners, this also includes built-in furniture and cabinets. However, it does not cover damage to personal belongings or any landscaping.

- Contents Coverage: This covers personal belongings within the building, such as furniture, electronics, and clothing. It’s particularly important for renters, as it protects their personal property. However, it does not cover items like vehicles or external structures.

Determining Your Risk and Coverage Needs

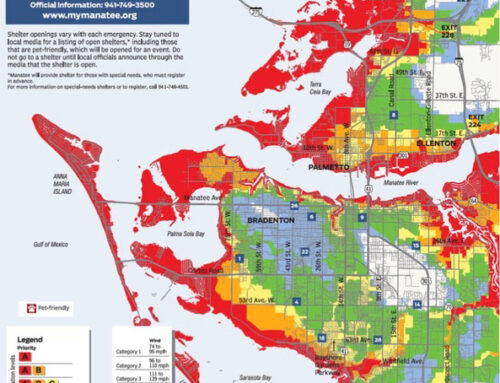

Florida’s flood risk is influenced by factors such as proximity to bodies of water, elevation, and historical weather patterns, including heavy rainstorms. FEMA provides Flood Insurance Rate Maps (FIRMs) that help homeowners determine their flood risk. Properties located in high-risk areas, often referred to as Special Flood Hazard Areas (SFHAs), may be required to purchase flood insurance if they have a mortgage from a federally regulated or insured lender.

Even if you are not in a high-risk area, flooding can still occur. In fact, a significant percentage of flood claims are made by policyholders outside these high-risk zones. Therefore, assessing your risk and considering flood insurance regardless of your location can be a wise decision.

Purchasing Flood Insurance Before Seasonal Rainstorms

To purchase flood insurance, you must do so through an insurance agent or broker who participates in the NFIP. Policies typically have a 30-day waiting period before they go into effect, so it’s important to plan ahead and not wait until a storm is imminent. The cost of flood insurance varies based on factors such as the property’s flood zone, elevation, and the amount of coverage you choose. Premiums can range from a few hundred to several thousand dollars annually.

Flood insurance is a vital component of financial protection for Floridians due to the state’s susceptibility to flooding from heavy rains and storms. Understanding the types of coverage available, assessing your flood risk, and taking proactive steps to purchase and maintain flood insurance can help mitigate the financial impact of flood damage.

While this may seem overwhelming, it does not need to be. Call Anderson and Associates Insurance Group for an appointment, and we will help you navigate obtaining the right coverage for your situation.