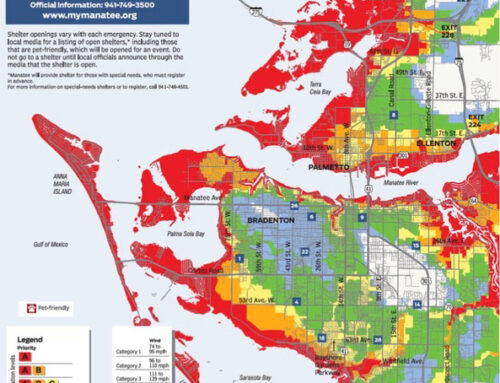

Here is South Florida, water is a way of life. Whether the Gulf of Mexico, the Manatee River, or Phillippi Creek – our waterways are pristine and cherished by all who live here. Unfortunately, this water which winds its way throughout much of our area can quickly become a big problem when a major storm hits and water damage occurs. Storm surges along coastal areas, and rising waters along creeks and canals both pose a water damage threat to area homeowners.

In fact, a few years ago. FEMA found it necessary to rezone most of the United States, declaring more areas than ever a flood zone. While purchasers of new homes were forced to buy flood insurance, other long-time residents found it nearly impossible to qualify for full water damage policies, based upon their location and proximity to water.

Homeowners also were often locked out of water coverage unknowingly. When they purchased hurricane insurance, they assumed that the waters which accompanied the storm would be covered, but they often are not. In fact without a flood rider, very little water damage is actually covered in a homeowners policy. This gap was a glaring issue in a sea-level state with lots of moisture, older plumbing and frequent water and plumbing backups due to excess storm water.

However, insurance companies are beginning to warm up to the idea of providing full water coverage to homeowners who are willing to retrofit their home with an automatic water shut off valve. This device provides checks on your water situation in two ways. In both situations, when the device senses a problem, it can shut off the water supply to the home.

1. The device monitors the flow of water through a pipe, and will shut the water supply off if it detects an irregular flow of water.

2. The device can detect water or moisture on the floor, and shut down the water supply to your home. This is a huge help to stop pipes from backing up as water had no where to go in flooded neighborhoods.

Though many automatic water shut off valves are on the market, not all may be acceptable to your insurance company. Be sure to check with your insurance broker to determine both if your insurance provider offers extended water coverage, and if so, which devices qualify. In most cases, devices must be able to be remotely monitored and controlled by a smartphone app.

As is the case with any home improvement which may lower insurance rates, proof of purchase and installation will be required in order to prove you are proactive against water damage. Keep all receipts and invoices, and have your device installed by a licensed plumber. Be sure to take photos of the installed device as well.

The extended coverage for this type of device installation is one example of the discounts, allowances and breaks which many insurance companies offer unbeknownst to their clients. If you are looking for ways to maximize your Florida homeowners insurance coverage – while saving money on premiums whenever possible – the smart move is to call Anderson & Associates Insurance Group. We are aware of all the tips and tricks to getting the best possible coverage for your home -as well as your car, your business, and your family.

If this information was useful to you, call Anderson & Associates Insurance Group for more insider information and expertise.