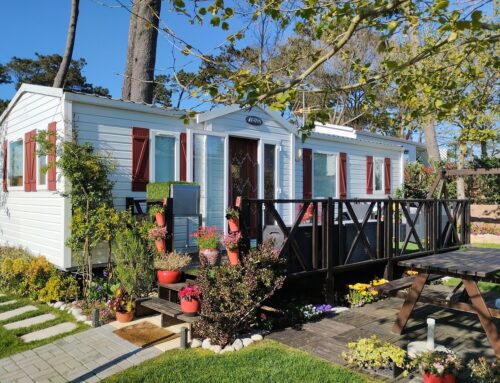

If you’ve never considered a mobile home, you may be surprised by how prevalent they are in Florida – and how similar they are to traditional homes. One way they are similar is their need for insurance to protect them from danger and damage, and mobile homeowners face many of the same insurance challenges as others in the state. Mobile home insurance isn’t overly complicated, but there are many things to keep in mind if you wish to secure the best policy to protect you, your family, and your investment.

Mobile Homes in Florida

Florida hosts hundreds of thousands of mobile homes, making it the state with the third-highest number in the country. This high prevalence is driven by Florida’s retirement community appeal, relatively lower housing costs than other expensive coastal locations, and the flexibility mobile homes offer residents. Most mobile home communities have amenities similar to those in traditional housing developments, such as community centers, pools, and social activities.

Given Florida’s weather conditions – high heat, frequent hurricanes, tropical storms, storms, and flooding – the need for specialized mobile home insurance is more pronounced here than in many other states. If you simply leave a mobile home to fend for itself against nature, it may not last long without repairs. Insurance policies must adequately cover natural disaster risks and damage due to common Florida concerns for mobile homes to compete with standard homes.

Insurance Considerations for Mobile Home Owners

Whether you’re contemplating the purchase of a mobile home in Florida or already own one, insurance should be a consideration from the beginning of your journey. Premium costs are primarily driven by:

Location and Risk Exposure: Homes in coastal regions or flood-prone areas are at a higher risk of storm and flood damage, which can drive up premiums. Conversely, mobile homes in more inland or sheltered areas may enjoy relatively lower insurance costs. You can find your risk of flooding using federal government tools like FEMA’s flood map system. Even with a 1% chance of flooding per year, that equates to a 1 in 4 chance of a flood during the typical length of a home mortgage.

Age and Condition of the Mobile Home: Older mobile homes can attract higher premiums due to the increased risk of issues related to aging infrastructure. If you spring for an updated mobile home with modern fixtures and fittings, especially those built to withstand hurricanes, you can often benefit from lower insurance costs.

Security Measures and Upgrades: Insurance companies often offer discounts for mobile homes with enhanced security systems, storm shutters, reinforced roofing, and other protective measures. When insurance companies don’t expect the need for constant repairs, they can pass savings on to policyholders. Even if you have insurance, the ideal situation is one in which you don’t need to use your policy.

Insurance is key to protecting your mobile home from damage, but acquiring the cheapest policy may not always get you what you need.

Gaps in Mobile Home Insurance Coverage

It’s important to be aware of what standard policies typically do not cover and to consider additional insurance to fully protect your property. Exclusions typically include:

Flood Damage: Standard mobile home insurance policies do not usually cover flood damage. We’ve already discussed how important flood coverage is, but you can’t expect a basic policy to help. Some insurance companies may provide flood coverage, but others may not, meaning you must seek out other companies or federal programs to get the coverage you need.

Windstorm Damage: Standard policies might exclude damage in high-risk coastal areas due to how common and expected it is. Owners may need additional windstorm coverage to protect against natural disasters that routinely hit Florida.

Earth Movement: Standard policies generally exclude damage from sinkholes or earthquakes. While not as common threats, additional coverage for these risks may be available at minimal extra cost and advisable in certain areas.

Many other components of your mobile home insurance may be lacking or warranting an upgrade, but you will have an easier time exploring your options after talking to one of our agents and explaining your current situation. We can help determine if additional coverage in areas like liability or property protection is available at a more favorable policy price. Contact Anderson & Associates Insurance Group today to get in touch with our team and get started.