Florida, with its vast coastline and low-lying topography, is one of the most flood-prone states in the U.S. Flood damage can be catastrophic, and even areas that are not in designated high-risk zones can be affected by severe weather events. Given this, many Florida homeowners wonder whether they should invest in flood insurance – even if they are not required by law. Understanding the necessity of flood insurance in Florida and how FEMA flood maps factor into the decision-making process is key to making an informed choice.

The Importance of Flood Insurance for Florida Homeowners

Flooding in Florida can occur for a variety of reasons, such as hurricanes, tropical storms, or heavy rainfall, even in areas that aren’t traditionally prone to floods. Because of this, the risk of flood damage is widespread, and homeowners in Florida are encouraged to consider flood insurance—whether they live in a high-risk flood zone or not.

Here are several reasons why flood insurance should be considered by all Florida residents:

Florida’s Flood Risk: While flood insurance is often associated with coastal areas and those near rivers or lakes, Florida’s geography increases flood risks across the state. Coastal areas are naturally more vulnerable to storm surges from hurricanes and tropical storms, but inland areas are not immune. Heavy rainfall can lead to flash floods, affecting properties far from major bodies of water.

Standard Homeowners Insurance Doesn’t Cover Flooding: Many homeowners mistakenly believe that their standard homeowner’s insurance will cover flood damage. However, flood damage is explicitly excluded from most traditional policies. If a homeowner in Florida experiences flood damage, they will need a separate flood insurance policy to help with the financial burden of repair and recovery.

Protection Against Financial Loss: Flooding can cause extensive damage to homes, businesses, and personal property, which often requires costly repairs. Without flood insurance, homeowners might be forced to pay out of pocket for repairs or even face complete loss of their home or property. The National Flood Insurance Program (NFIP) provides affordable flood insurance options to homeowners, renters, and businesses, offering crucial financial protection.

FEMA Flood Maps and Their Role in the Decision

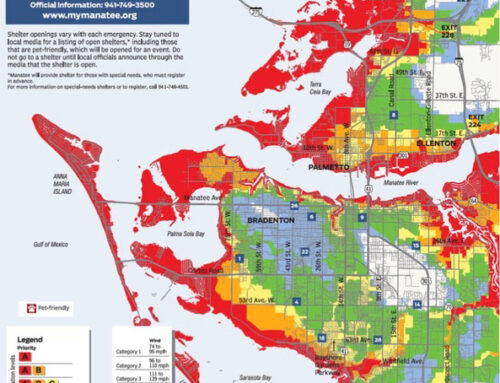

FEMA (Federal Emergency Management Agency) produces flood maps known as Flood Insurance Rate Maps (FIRMs), which are used to help determine the level of flood risk in various areas. These maps are essential for understanding whether flood insurance is required and how much it will cost.

High-Risk Flood Zones (Special Flood Hazard Areas): FEMA classifies areas based on the likelihood of flooding. The most common classification is known as the Special Flood Hazard Area (SFHA), which includes flood zones like Zone A and Zone V. In these areas, flooding is expected to occur with a high degree of regularity (a 1% chance or greater each year, often referred to as a 100-year flood). Homeowners with federally backed mortgages are required to carry flood insurance if they live in these high-risk areas.

Moderate and Low-Risk Areas (Non-Special Flood Hazard Areas): Not all areas in Florida are in SFHAs. FEMA identifies zones outside of SFHAs as lower-risk flood zones (e.g., Zone X). Homeowners in these areas are not required by federal law to purchase flood insurance. However, this doesn’t mean they are immune to flooding. In fact, about 25% of flood claims come from properties outside high-risk flood zones, indicating that moderate to low-risk areas can still experience severe flooding.

Risk Varies Over Time: FEMA’s flood maps are periodically updated to account for changes in flood risk, especially as new data is gathered or due to significant environmental changes, such as rising sea levels. A homeowner who is not in a flood zone today may find themselves in a high-risk zone in the future. It’s important for Florida residents to regularly check these maps to stay informed about the latest flood risks for their properties.

Insurance Costs and Optional Coverage: For those in moderate- to low-risk areas, flood insurance is optional, but it can be a prudent investment. The cost of flood insurance is generally lower in these zones compared to high-risk areas, but it can still provide peace of mind in the event of an unexpected flood. In many cases, the cost of flood insurance may be affordable enough to make it worth the investment, even for homeowners who are not required to purchase it.

As the frequency of severe weather events continues to rise, investing in flood insurance can be an important step in protecting both your property and your financial future. Ultimately, understanding the flood risk for your area—and choosing to be proactive in securing coverage—can offer invaluable peace of mind.

Anderson & Associates Insurance Group provide professional insurance advice for homeowners in Sarasota and Manatee County.