Florida homeowners are no strangers to extreme hurricanes, and after two recent hurricanes, many may be assessing whether they have the proper insurance coverage in place. Hurricanes bring wind, but that wind also carries water, sometimes very far inland. Flooding is actually one of the most expensive aspects of natural disaster damage, yet many Floridians are unaware that their standard home insurance policy doesn’t cover flood damage. If you were hit hard by the recent storm or escaped with minimal damage, you should review your current policy and make sure you are prepared for next time.

What is Flood Insurance?

While standard homeowner’s insurance typically protects your home from risks like fire, theft, or wind damage, it does not cover losses resulting from flooding; flood insurance shores up this deficiency.

These insurance policies cover damage to a home’s structure, materials, and, in many cases, its contents. If your foundation, electrical and plumbing systems, or appliances are damaged, flood insurance can help with repairs and replacements. Additionally, some forms of flood insurance cover personal belongings like furniture, electronics, and clothing.

Why is Insurance Against Flooding Not Standard?

Many homeowners, especially in a flood-prone area like coastal Florida, assume that their standard home insurance policy will cover any type of disaster, but flood insurance is typically not included as part of these policies. The main reason for this is the unique risk that flooding poses. Flooding can cause widespread damage, affecting entire neighborhoods and cities, which makes it an extremely high-risk event for insurers. Because a bad storm or hurricane can cause a considerable magnitude of potential claims after a flood, insurance companies separate this risk from basic homeowner’s policies, allowing each homeowner to decide whether or not additional premiums for flood protection are worth it.

This means that unless you’ve specifically purchased insurance to protect you against a flood, you may not be covered in the event of flood damage. And unfortunately, many homeowners don’t realize this until it’s too late—after a hurricane or heavy rainfall has already caused significant damage. Without flood insurance, you could be left with massive repair costs and no financial assistance to rebuild your home.

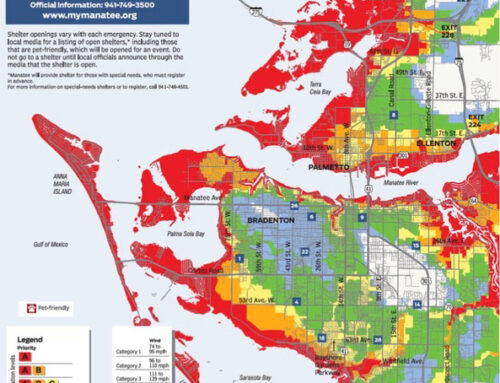

Homeowners can check their flood risk using tools like FEMA’s Flood Map, but that doesn’t mean someone outside these zones should consider flood insurance. Over 20% of flood claims come from low—to moderate-risk areas, and we have recently seen how far inland water can travel through Hurricanes Helene and Milton.

Don’t Face Flooding Without Professional Assistance

We’ve recently been discussing various concerns and struggles that Florida homeowners have faced during this hurricane season on our blog. Our primary aim is to provide your household with the best policy to protect your family in the future. It’s been a rough month, and if you have been worrying about insurance deductibles, premiums, and coverage limits, now is the perfect time to review your plan to make sure everything is perfect before the next hurricane season.

The home insurance experts at Anderson & Associates Insurance Group will listen to your insurance concerns arising from these latest storms, review your current policy with you, and determine the best path forward. When your insurance coverage is sufficient, you have one less thing to worry about when the next storm approaches.