If you have ever obtained homeowner’s insurance in order to purchase a new home in the Sarasota area, you likely had to determine where the home was situated on the FEMA flood map. While it is recommended that all area residents purchase flood insurance, those who live within designated areas on the FEMA flood maps are required by their mortgage company to do so.

FEMA maps have been available for a century, but it was only in the last several decades that the maps have been redrawn. Because it has been determined that floods are a major source of insurance claims – in excess of $8 billion dollars per year in the United States alone – it became necessary to reevaluate risk zones in all coastal areas.

The following information was taken from the official FEMA website in regards flood zones and insurance requirements.

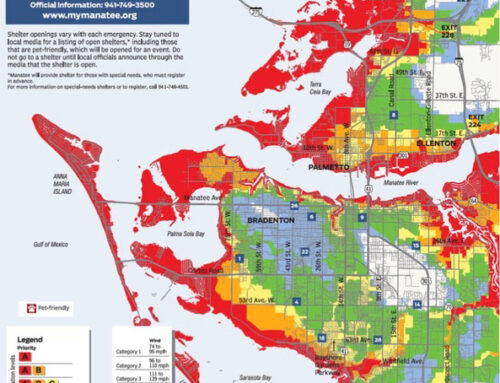

- FEMA flood maps are officially called Flood Insurance Rate Maps. They outline a series of flood zones, indicating areas of high risk, moderate risk or low risk for flooding.

- Communities and municipalities utilize these flood maps to establish minimum building requirements for coastal areas and floodplains.

- Lenders use the maps to establish flood insurance requirements for those seeking a new mortgage.

Special Flood Hazard Zones

High risk flood zones are indicated on the maps with the letters ‘A’ or ‘V.’ These zones are determined to have a minimum 1 in 4 chance of flooding during a 30-year mortgage. All home owners with federally regulated or insured mortgages (the majority of all conventional or FHA loans) are required to buy flood insurance if their property falls in one of these areas.

Non-Special Flood Hazard Areas are though to present a moderate-to-low risk of flooding. Although the chances of a flood occurring is greatly reduced, it is not removed completely. These zones are indicated by the letters ‘B’, ‘C’ or ‘X’. People living within these zones are not typically required to purchase flood insurance in order to obtain a mortgage.

Did You Know? Even with lower risk, these areas submit more than 20 percent of flood insurance claims – and are the recipients of one-third of federal disaster assistance for flooding. These statistics indicate that all residents in coastal areas should consider flood insurance, even if it is not required.

Where Can Flood Insurance be Purchased?

Most flood insurance is obtained through the National Flood Insurance Program (NFIP) administered by the Federal Emergency Management Agency (FEMA). A flood insurance policy may require 30 days from the date of purchase for coverage to be activated.

If you have are purchasing a home in the Sarasota, Bradenton, or Parrish area, the FEMA flood maps will be consulted as to the property’s flood risk. Even if the home is located far from the Gulf or Bay, you may be in a high-risk zone if you are close to a river, lake or other waterway.

It is recommended that you ask about the possibility of flood insurance at the beginning of the mortgage process, as the additional premium will be figured into the overall cost analysis. If you have questions, call the professionals at Anderson & Associates Insurance Group. We have been providing homeowner’s and flood insurance to home buyers for years, and are proud of our reputation in the area. We welcome your questions and requests for insurance quotes to support your purchase.