There is a lot of personal data floating around these days. From social media profiles, to online banking and public wi-fi, criminals have more opportunities than ever before. It is no wonder that in the last decade, there has been a surge in the levels of stolen data, identity theft, and other schemes designed to defraud innocent citizens. As an insurance company, we are dedicated to protecting our clients from all types of threats and circumstances. To that end, here is a rundown of some of the most common scams out there.

It is our hope that you will learn the signs of these frauds and scams and take steps to protect yourself.

Common Scams Designed to Con You

Phishing: Unsolicited emails, calls, texts and letters qualify as “phishing” scams when they attempt to trick you into sending money to a third party. They may also be trying to infiltrate your electronic accounts for personal data and identity theft. These scams started out as the infamous “a relative left you money” scam, but have evolved into far more sophisticated schemes. The criminals will go to great lengths to make the communication look legitimate, changing only one character in the web address, or using a logo that looks exactly like a trusted vendor. Your best defense is to never give out money or information unless you initiated contact. If you do receive something that seems legitimate, call the sender to confirm it came from them.

Fake Social Media Profiles: While the most prevalent abuses occur on dating websites, criminals of all types create fake profiles to hide behind another person’s identity. While you may think you are safe, consider that by using a photo and name, people can contact you pretending to be your family, an old school friend, or your boss. Many people less familiar with social media are not aware how easy it is to impersonate someone else. If you receive messages asking for money or information seemingly from someone you trust, double check to make sure it is the same account you have been interacting with previously. (usually via a message history.) If someone is looking for something, get back to them on another form of contact, such as through an email or phone call. This will quickly flush out an imposter.

Threats and Scare Tactics: Over the last few years, there has been an epidemic of calls to unsuspecting targets which tries to scare them into making a payment. One of the most common examples is a call from a person identifying as the IRS, stating that you owe money and will be arrested if you do not send payment. These individuals can be quite persistent and convincing, usually getting increasingly nasty as the call goes on. Remember that the IRS will never call you to solicit money. Another version of this call will go so far as to say that there are officers waiting down the street to arrest you if you don’t comply. Hang up and don’t give them any information. This is completely fraudulent activity.

Viruses and Malware: The most common scams can sneak up on you. When browsing online, spyware, viruses and malware can be installed on your computer; causing a multitude of problems from stolen data to completely disabling your computer. While only visiting trusted sites is a good start to protect yourself, every user should have anti-virus and malware protection on each of their devices. A virtual private network, or VPN, is also a necessity to mask your data, identity and location when utilizing free or public wi-fi networks.

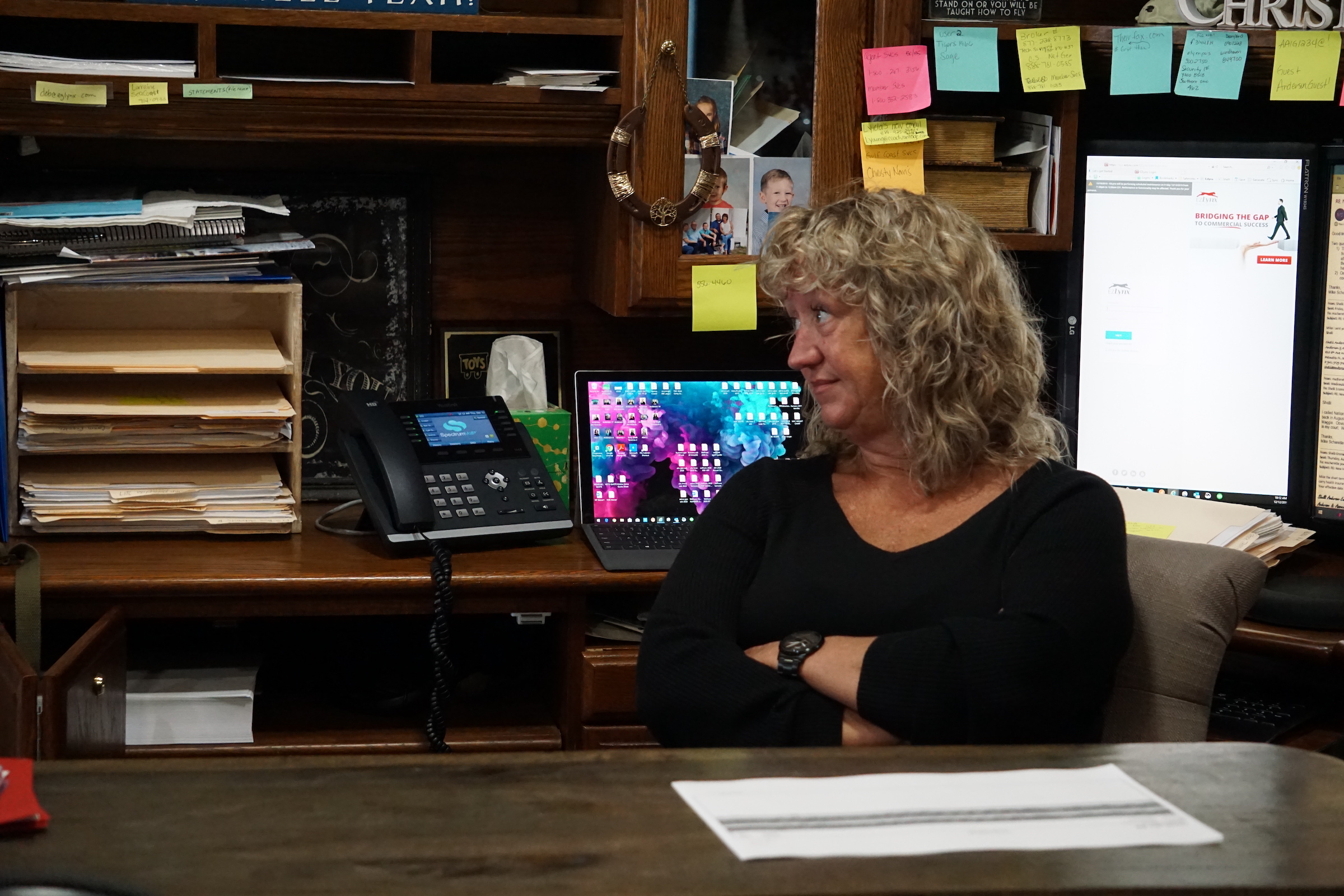

Anderson & Associates Insurance Group is here to help protect you from other types of threats – sickness, job loss, car accidents, property damage from severe weather, and more. No matter what type of insurance you need, we are your one stop shop in the Sarasota and Bradenton area. Call us today, and sleep easier tonight knowing you are protected.